Africa Carbon Coin

Africa’s Environmental Trading System

ACC is a blockchain-powered emission trading marketplace that turns Africa’s climate projects into certified, high-value carbon credits. These credits are securely tokenised and traded globally, giving African developers direct access to compliance and voluntary carbon markets. With SAP integration, ESG automation, and transparent trading, ACC helps enterprises meet climate goals while driving new investment into Africa’s green economy.

What is ACC?

ACC integrates with the Verified Carbon Standard (VCS), SAP, and local tax compliance frameworks to make carbon credit trading fast, secure, and fully compliant. Our platform uses blockchain, real-time trading, and DeFi access to boost credit liquidity and channel green finance directly to verified projects. Every sale fuels Africa’s clean energy future—creating a self-sustaining loop that funds new climate initiatives, generates more credits, and delivers measurable returns for investors, communities, and the planet.

Unlocking $40 billion in untapped carbon credit revenue by connecting Africa’s climate projects to global buyers.

Market Opportunity

Global Carbon Credit Market

$851 billion

(World Bank)

Global Carbon Market (2023)

Over $1.5 trillion

Projected market size, considering increasing demands and expansion of voluntary and compliance systems

Only 2%

Africa's current contribution of global carbon credits

Africa's Potential

-

Can offset 14% of global emissions but remains underutilized.

-

Potential to unlock $40 billion annually by 2030.

Africa's Challenges

-

High transaction costs (15-25%).

-

Slow verification (6+ months).

-

Limited access to global ETS platforms.

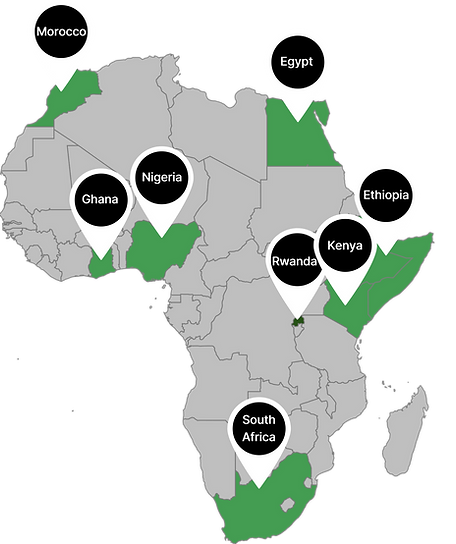

Africa

South Africa

A prime candidate for ACC integration due to existing carbon tax systems.

Ghana

Community-level projects and forestry initiatives.

Nigeria

Focus on industrial emissions and energy sector transformations.

Morocco

ACC integration for solar and wind energy credits.

Egypt

Integration with large-scale renewable projects.

Ethiopia

Focus on nature-based solutions.

Kenya

Ideal for leveraging ACC in agroforestry and community-based projects.

Rwanda

Small-scale but impactful carbon offset projects suitable for ACC.

What's holding Africa back?

1

Validation Delays

Current systems take 4–6 months to approve carbon credits.

3

Lack of transparency

$12 million worth of unverifiable credits (2022, UN data).

4 REASONS

2

High costs

Fees range from 15–25%, excluding smaller projects.

4

Regulatory Fragmentation & Lack of Technology Information

Disparate policies across African nations. Lack of access to technology and skills shortage.

Case Example:

Kenyan Green Wall project lost 40% of potential funding due to validation bottlenecks.

Discover the ACC Solution

Blockchain-Powered Infrastructure

Built on the Polygon network to ensure secure, transparent, and efficient tokenization of verified carbon credits.

Real-World Environmental Backing

Each ACC token is backed by verified carbon offsets generated from African renewable energy and sustainability projects.

Revenue Stream for Green Projects

Enables project developers to monetize carbon savings through

both local and international carbon credit markets.

DeFi Integration

ACC tokens can be staked, traded, or used as collateral within decentralized finance (DeFi) platforms.

African-Focused, Globally Connected

Designed to scale climate finance in Africa while offering international buyers a reliable way to purchase tokenized carbon credits.